Almost a year ago, on a tip from Richard Gilbert, RTH picked up on a mostly-ignored report in Platts Oilgram News that Saudi Arabia was past its oil production peak.

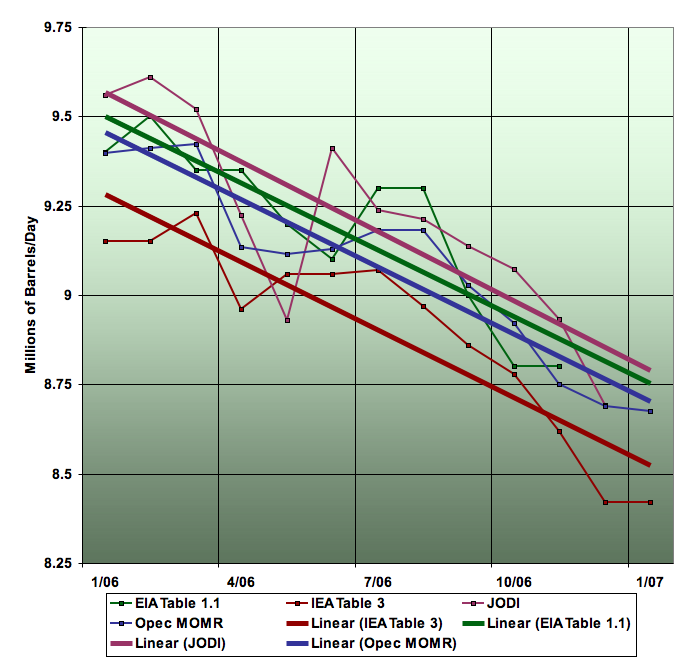

Today, over at The Oil Drum, Stuart Staniford reports that Saudi Arabian oil production dropped eight percent last year.

Saudi Oil production, Jan 2006 - Jan 2007 (Source: The Oil Drum)

Some commentators - including most peak oil deniers - are arguing that OPEC's oil production dropped last year because they want to maintain high prices.

However, this flies in the face of OPEC's longstanding policy, which is to keep oil trading in the $20-35 dollar range - high enough to be profitable, low enough to price non-conventional oil out of the market, and moderate enough to encourage steady consumption growth of around two percent a year.

We learned reecently that oil production has been stalled at 84 million barrels a day for the past two years, and many buyers, especially in less developed countries, are simply being priced out of the market as sustained high prices destroy market demand.

We are certainly being lied to about Saudi Arabia's oil reserves - and the reserves of every other OPEC country as well. In the 1980s, when OPEC changed its rules so that countries could only export oil based on their reserves, every country's reserve estimates jumped.

In January 2006, a leaked internal memo found that Kuwait's oil reserves were only around 50 billion barrels instead of the 100 billion the Kuwaiti Oil Company had been claiming.

Similarly, we are being lied to about Saudi Arabia's continued ability to crank out millions of barrels a day. Saudi Aramco has been pumping seven million barrels of saltwater a day into its massive Ghawar field just to keep production flat, and the water cut is a significant, and growing, share of the total output.

By David (anonymous) | Posted March 06, 2007 at 03:27:07

I still remember the photo of Dick Cheney walking with the sheeted ones in Saudi Arabia, with the caption asking what they may have been discussing.

Matt Simmons also stated that he believes S.A. oil is past peak and that they have resorted to pumping water in to extract more oil from many wells. There could very well be an unintentional loss of production.

But going back to that Dick Cheney photo, I wonder if the longstanding policy of a preferred price range has been perverted by suggestion from the US, partly to aid in the dollar support with the higher price through petrodollar recycling, or to ramp down as someone else such as Chavez or Iraq was ramping up. I believe the current oil price range is the US preferred price as a source of support for the dollar as countries begin to drop their dollar reserves, an event that may equate closely to the time line in the production chart in this story.

If the drop is indeed unintentional, then the steepness of the decline is sincerely alarming. But it is clear that the US wants the price very high. So even if it is unintentional, it may be playing well into the US hand.

One thing we certainly need the most, more than cheap oil or a respected dollar, are Washington politicians who once again start working for the people of the USA, and one of their firt assignments should be to TELL THE TRUTH !!!

By David (anonymous) | Posted March 06, 2007 at 13:23:53

Good points, Ryan. But I think there has been a shift in thinking about what the goals are. Past presidents spoke in ways of direct support of the prosperity of the US and it's people - to make the USA strong economically by helping oil to stay cheap and plentiful to power the economy which in turn took care of the debts. But now we seemed to have entered into a period where our economy can no longer pay for our own debt, other countries are losing the desire to do that, and with the dollar teetering on the brink the Neocons turned to the high price of oil and gunfire to support it, despite the burden on the US economy. The Federal Reserve system was based on ever increasing debt, and it has reached the runaway point without desperate actions to support it, which explains the total lack of concern by the Neocons about world opinion - they appear almost insane due to the lack of truth about what is really going on. People in the US assume the madness is serving them somehow based on belief that presidents have always been on their side, but instead they are working now for the bankers.

I'm sure they are scrambling to repair Iraq's oil infastructure, as it will be a tool to help prevent runaway prices when they start bombing Iran. I used to believe that would never happen because of the consequences to oil prices, but now that we have entered this new shift in philosophy, high oil prices are exactly what is called for, along with the elimination of the additional direct threats to the dollar by Iran's move toward the Euro.

It was oil pouring out of Iraq in 1999 that caused the gas prices in the US to drop to 89 cents per gallon. Saddam had too much power to jerk the markets, and his move to the Euro was a direct threat. Nobody can conclude the Middle East was less stable then - such stability was indeed a problem for this new goal shift toward saving the dollar. The US can't allow enemies in the Middle East to have that kind of power.

In short, if you consider support of the dollar above all else, then actions past and planned do make sense. The US doesn't want the oil, they want to control it's distribution, and build a permanent presence to ward off future threats to the dollar. Although the US people may ultimately benefit from this, their prosperity has largely been considered collateral damage as a process to support the dollar's hegemony in the world. Rarely is there motive not exposed by following the money.

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?