With all the press recently given to the domestic auto industry's woes, you might think somebody would ask why they are in such dire straits.

Why are they special? Global competition is the rule for most industries. Unions with high wages are still pretty common. Other industries have big pension obligations. Still others are just as highly affected by high oil prices.

Inferior quality is a poor argument when watchdogs like Consumer Reports have noted for about a decade that North American cars are more reliable than European imports.

Are they really making vehicles that nobody wants?

Every industry has a segment of luxury products, small or large. With autos, there have always been sports cars and large leather upholstered highway-liners.

Historically, those segments only made up a minority.

For the last two decades, a new luxury indulgence has been sneaking up on us, based on size and not much else – truck 'technology' derived pickups, SUVs, and vans.

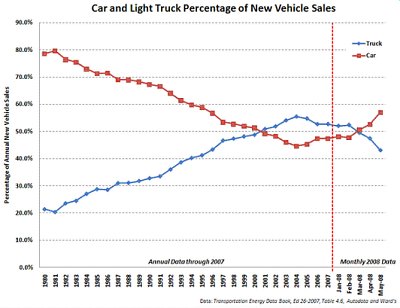

Image Credit: Green Car Congress. A seismic shift in vehicle types.

Unlike in days past, when such vehicles were mostly used for their intended purpose, now urban and suburban dwellers primarily drive them - and insist that they need them.

Of course, that is absurd. But this realization is only starting to dawn on some SUV and truck owners, because of the powerful and insidious marketing propaganda of the big three.

Now, forgive my use of sexist stereotypes to illustrate this point, but everyone knows that a stylish woman's two-dozen shoes which cost a couple grand are an indulgence. But her boyfriend's truck is pricier than a car that would do the same job, by a couple grand per year. And he will f'ing lose it if anyone dare suggest that his truck is an extravagance.

Industry's motivation is simple. If they can sell a $20,000 car and net $1200 profit, or a $25,000 truck netting $5000 profit, where should they put their advertising dollars?

The industry's error was thinking this swindle could go on forever. You can't fool all the people all of the time.

When over half of the population drives a light truck, it represents an unsustainable level of luxury in terms of segment size, considering fuel consumption and ownership costs.

Which is why, when a recession hits, an industry that has developed itself to be dependent on high-margin but ultimately obsolete and unnecessary large vehicles, deserves to be humbled.

Now the government bears some of the blame in facilitating this bubble, with their too easily lobbied-away concessions in light truck fuel economy, emissions and safety standards.

But the public shouldn't forget their crucial contribution.

By jason (registered) | Posted December 31, 2008 at 09:02:15

it's an interesting discussion to say the least. We've been bailing these guys out to the tune of billions over the past 10+ years. It goes to show how deep the oil/auto/sprawl industry runs in government. Think of the trillions of dollars that North American governments have spent just to give Henry Ford's invention a place to drive and park. I'm not sure that another industry comes close to having received the amount of public money that this one has in the past 6 decades. I guess governments figure they can't stop now. They're in too deep.

By ModelT (anonymous) | Posted December 31, 2008 at 10:00:22

Jason, you are so misguided and as usual bland in your analysis and thinking. What you call the "oil/auto/sprawl industry" creates millions of jobs in Ontario, Canada and the world. To stop subsidizing these industries is to terminate those jobs. Ted raises important questions in terms of the products being churned out that 'nobody wants' but to just say that political patronage is responsible for supporting this industry is to doom the Ford, GM, Chrysler, parts manufacturers and steel workers, to name just a few into welfare dependency. Give your head a shake!

By gullchasedship (registered) - website | Posted December 31, 2008 at 11:14:43

Doom them to welfare dependency?

They're already welfare dependent. It's just that the cheque/tax breaks/incentives go to the corporation that hires them rather than to the employee.

We need to close the public trough to these unsustainable corporations. If they can't survive in our economy, then we should let them die.

By Brandon (registered) | Posted December 31, 2008 at 12:09:32

If the economy was doing fine, then "let them die" would be an acceptable approach. However, given the fragility of the current state of affairs, "let them die" would end up putting millions out of work in North America. Good idea? I don't think so. Can you name another industry that has so many spinoff jobs?

Not only that, but the majority of their problems aren't caused by the product mix, it's caused by an inability of people to get credit to purchase their product. It's tough to argue that the financial crisis was caused by the manufacturers.

Sure they were badly hurt by the rising gas prices, but they are/were in the process of shifting their product mixes to compensate. I know for a fact that GM had put its high performance division (HPVO) on hold and were focusing on hybrids. Too little too late? Maybe, but the credit crunch came at the worst possible time for them.

All the downsizing their doing isn't a bad thing (provided you aren't the one being downsized), as it means that should they eventually go under, it's less jobs being lost all at once.

By Brandon (registered) | Posted December 31, 2008 at 12:21:23

If the economy was doing fine, then "let them die" would be an acceptable approach. However, given the fragility of the current state of affairs, "let them die" would end up putting millions out of work in North America. Good idea? I don't think so. Can you name another industry that has so many spinoff jobs?

Not only that, but the majority of their problems aren't caused by the product mix, it's caused by an inability of people to get credit to purchase their product. It's tough to argue that the financial crisis was caused by the manufacturers.

Sure they were badly hurt by the rising gas prices, but they are/were in the process of shifting their product mixes to compensate. I know for a fact that GM had put its high performance division (HPVO) on hold and were focusing on hybrids. Too little too late? Maybe, but the credit crunch came at the worst possible time for them.

All the downsizing their doing isn't a bad thing (provided you aren't the one being downsized), as it means that should they eventually go under, it's less jobs being lost all at once.

By Brandon (registered) | Posted December 31, 2008 at 12:38:38

To go back to the tone of the article though, the government is putting out two very distinct and conflicting messages.

1) Through CAFE, they are mandating efficient vehicles. 2) Through low gas prices, they are encouraging people to purchase inefficient vehicles.

As gas prices have dropped, we've seen truck demand rise again as those prices were obviously an anomaly. The only way to truly change the mix is to stop sending one of the conflicting messages. Either tax the hell out of gas to bring it back up to high levels again or remove CAFE and stop fining the industry for selling products that people are encouraged to buy by low gas prices.

By jason (registered) | Posted December 31, 2008 at 14:52:45

ModelT,

It's all about the jobs?? Then why don't we give billions to arts and culture?

http://www.canadacouncil.ca/aboutus/advo...

If you actually think it's all about the jobs, perhaps you should give your head a shake.

By jason (registered) | Posted December 31, 2008 at 14:59:50

as an aside, we've been giving huge public bailouts to these companies for decades and this is where it's gotten us. So, perhaps we do it again and save the jobs for another 5 years?, 10 years??? I don't want to see Canada lose 400,000 jobs any more than the next guy, but it's going to happen sooner or later? And don't forget, some of these jobs can be replaced with new auto manufacturers (most likely the Japanese/German ones) that actually have a clue how to build for the future.

I'm all for "investing" billions of taxpayer dollars into the economy, but only when that money produces lasting results. Constantly bailing out private companies is not the role of government.

By Grassroots are the way forward (registered) | Posted December 31, 2008 at 22:45:56

Ted: You bring up some interesting questions.

Union wages: The numbers of unionized workers in the private sector is now about 20%, thereabouts. Many workers have seen marked decreases in wages, benefits and no pensions. The auto industry, has been using temp workers at lot which denies workers to the same wage as the union counterparts, they are denied benefits and have no real rights in the workplace. This creates a divide within labour. This is about a takedown of the middle class, the blue collar workers, the propoganda is everywhere but what is there to replace it, nothing, people are left to struggle on their own and no real plan in place to help people make the transition when there is no jobs or a tightening job market.

Many people have their own business, which they need trucks to do their work, a small car would not carry the equipment and so on, so what are these people to do? How many jobs would this affect?

Clearly the blame falls on the Captains of Industry, the elite of our society who have caused this fiasco. People talk about free market but for the most part the auto industry is an oligioply. Those who may have "green" ideas are faced with many regulations and so on which deters the free market and innovation.

Social responsibility: We all play a role, yet the very system is lacking those voices from the people, the grassroots. The problem is that the voices from the business lobby outweight those voices from the people, there not many forums or soapbox type of forums where the people are given the opportunity to speak out and with watching what is going on in the US, soon it may be against the law to speak out, the suppression of free speech, the right to peacefully assemble, remember now our leaders have an agreement to have the miltary from either country to enter the others if there is civil unrest. But who determines what is civil unrest, when people can no longer feed their families, have no jobs or hope for the future.

Ted makes the comment that the government is partly to blame, so let me ask you this question, who is the government? Does the government represent the people anymore? It seems to me the the business lobby is the government when the lobbyists have more access then the people to push through their agendas, which is a determent to the people in terms of job loss, decreasing ability to survive in terms of being able to earn a living wage and provide for their families. Ted, you are missing the greater picture of what is going on.

There should be no bail out to the captains of industry, the elite of our society, it should go to the workers, the people, the families affected. But then the people do not have a voice any longer do they!!!!!!!

By ModelT (anonymous) | Posted January 02, 2009 at 08:08:59

Jason said,

"as an aside, we've been giving huge public bailouts to these companies for decades and this is where it's gotten us.

So, perhaps we do it again and save the jobs for another 5 years?, 10 years???"

So, go tell the guy at Ford who has been laid off or the men and women at Dofasco who have been shut down for a period of time, or at US steel that we can't invest in their jobs becuse they would only last '5 to 10 years' and that isn't good enough. Sorry. Pack up your bags and join the welfare lines.

Jason, give your head a double shake. Maybe they are hiring wherever it is you work or maybe 5 to 10 years of employment isn't good enough for you, but when you are sruggling, it is a lifetime, not just a lifeline that the government is handing you!

By jason (registered) | Posted January 02, 2009 at 09:33:02

hey, believe me. I feel for the workers. they are the innocent victims in all this.

The CEO's will stay filthy rich, while regular folks are forced to start over.

Where are all the 'free market' people??

Please explain how giving billions to these companies (again) is anything but socialism.

Only in this breed of socialism, it isn't for the poor or marginalized. It's for the mismanaged, greedy, selfish elites.

This board used to be full of people with screen-names like 'capitalist' and 'small government' etc....

where are they now?

As much sympathy as I have for people who lose their jobs, the fact is we can't simply start bailing out every company that threatens to close.

In a balanced, sustainable economy there should be new start-up firms, new technology firms and 'futuristic' companies being encouraged that can replace some of the lost jobs.

Dr. Richard Gilbert did a great study in Hamilton quite a few years ago called 'The Electric City'. It was basically a blueprint for developing a sustainable economy in Hamilton that would not only survive, but thrive once these old, run-down, ragged dinosaurs began to fall. We've all seen this coming for many years. As usual, government has done nothing to prepare and in Hamilton's case, they've simply shelved Dr. Gilberts fabulous study because it wasn't business as usual. I'd much rather see the government invest in ideas such as the ones he proposed and see new factories locate here that are world leaders in wind power, solar power, electric development, infrastructure needs etc.....

Portland, Oregon recently started heading this direction when it lured the first ever 'modern streetcar' factory in America. You can be sure that there is a bright future for those types of plants. Cities like ours who do nothing but lag, will end up losing many jobs as you've mentioned. With dwindling capital to invest in North America, it would be foolish to invest it in these industry relics. Invest MY tax money into the future.

By Ted Mitchell (registered) | Posted January 04, 2009 at 11:02:13

Appreciate all the comments.

I didn't bring up the debate of whether to bail out or not, that has been discussed in the press ad nauseum, it is complicated and I don't have anything useful to add.

Brandon raises an excellent point about conflicting messages, and without a significant hike in gas tax - comparable to Europe's roughly $1 /L, mandated fuel efficiency standards won't make much of a dent.

Grassroots, point 2, I couldn't disagree more. There is nothing in present day circumstances to justify the increase in truck sales beyond the 20% baseline in 1980. With people moving from farms to cities, it should be less. Almost all construction workers drive trucks to their jobsites, carrying just a toolbox and a lunch. Shoppers drug mart has a fleet of small trucks - to deliver small bags of pills 99% of the time. The number of jacked up, chromed out trucks and SUVs seems to be ever increasing. These are primarily fashion symbols, and plenty of people do just fine in their small business with hatchbacks and wagons.

Every time I've been at Home D, putting a bunch of 8' 2x4's in the hatchback and closing the trunk, and some 4x8' plywood on the roof rack is not a problem. But a similar load gives major headaches to the guy with the image truck, i.e. back seat forcing a short box with obligate fiberglass top, he's still trying to tie it all in when I'm driving off. Idiot. But if he never asks himself the question 'why?', then all the present advertising and cultural circumstances reinforce his choice.

Do guys in country music videos drive hatchbacks? I don't think so.

Grassroots, point 5, good point, I'm well aware of that. If people had equal input to business lobbies, then the concept of vehicle compatibility in crashes would be widely known and regulated. Because it's still ignored, lots of people die, about 4% of the total. search 'LTV incompatibility'.

There would also be clever counterpoint to the big 3's ads with SUVs on top of places unscalable by mountain goats. There would be no loopholes for trucks in terms of fuel economy and emissions (occupant safety has only been brought in line in the last 5 years) and regulations would recognize end use, not vehicle type. So the truck would count as a car in CAFE unless it is a business vehicle for a farmer, contractor etc.

If the US lobbying industry is unfamiliar to readers, check out Thomas Frank's 'The Wrecking Crew' - it's an eye-opener.

By A Smith (anonymous) | Posted January 04, 2009 at 12:14:59

Ted, I think we should put you in charge of the auto industry. You obviously understand better than anyone, including millions of consumers, shareholders and of course the auto executives on what needs to be built. Never mind that individuals have their own preferences that change over time as the price of inputs change (fluctuating gas prices), no one truly understands what the consumer needs more than you do.

In fact, by centralizing decisions on what needs to be built, you also take away the need for advertising and competition. Forget that diversity, both in nature and in business, usually leads to a more successful and healthy world to live in, what we need more than anything is uniformity. Uniformity stops humans from making bad decisions, which of course is the worst thing humans can do.

Forget that mistakes are also a fundamental part of developing and learning (Edison, Banting, Wright brothers) they are simply to painful for humans to have to endure. Alternatively, you can leave the money in the hands of the people who earn it, let them decide what they feel is best for themselves and otherwise f#!@ off. Now that I think about it, that's probably the best way to go.

By A Smith (anonymous) | Posted January 04, 2009 at 20:58:34

Ryan, where do most of the new, most innovative companies come from? It's not Germany or Japan, but the U.S.A., where failure has, up until recently, been embraced as a badge of honour. By allowing companies to sink or swim on their own, which includes allowing workers to lose their jobs, the U.S. economy has provided the world with the greatest and most diverse market for goods and services.

Whereas most people look at failure as a negative thing, it is also has a positive side. Take the recent housing bubble as an example. The people who were smart and sat on the sidelines as home prices went through the roof, are now in a position to scoop up real estate on the cheap. The same thing goes for banks that were prudent in their lending style. Therefore, over time, there will be a whole new set of winners in the U.S. economy, it's just that they will be the ones who were smart enough to do it on their own.

Over time, this freedom based approach acts as a filter to keep the best and brightest in control of most of the capital. When you combine talent and capital, you get good business decisions, which ultimately helps economies produce better products more efficiently.

The alternative is to let government impose "sensible" regulations, which while they may help certain industries, limit the benefits that come from failure. By decreasing the turnover of capital, you smooth out the disruptions these failures entail, but you also miss out on the next big thing. That is why Japan or Germany will never the lead world in bringing forward value added ideas, but will be resigned to second tier adopters of new technologies and business innovations.

I understand there has to be a balance between chaos and order, but I think the examples the twentieth century gave us point to erring on the side of too much chaos, rather than too much order. All one has to do is look at which economy produced the greatest advancements in technology, the U.S.A., or the former U.S.S.R..

One economy produced output based on signals from the consumer and the other produced output based on ideas from politicians. The former gave us T.V.'s, computer games and modern electronics, the latter gave the world nothing that consumers value.

By Brandon (registered) | Posted January 04, 2009 at 22:13:22

I agree, deregulation is the way to go. Nothing like a worldwide credit crisis to stir the old innovation, eh? Smartest people in the room? If you don't believe them, just ask them, they'll tell you.

By A Smith (anonymous) | Posted January 04, 2009 at 22:43:38

Brandon, the term "credit crisis" was put out by the one's who messed up. They knew that in order to get bailed out, they needed to scare the public into believing that we were all headed for another "Great Depression". Never mind the fact that over the last 4 quarters, real GDP is up almost 1% in the U.S., hardly a depression.

Furthermore, the only ones calling for more government are the losers, the last people government should be listening to.

If the banks that over-leveraged themselves had been allowed to fail, the only thing that would have happened is that those who survived would have gotten bigger. Smart banks would have replaced stupid banks.

Once again, the free market is not about outlawing failure, it is about creating an environment where the smartest companies are allowed to take on an ever larger role in producing what consumers are demanding. By introducing regulations to limit this natural flow of capital, you are simply slowing the natural progress that comes from allowing businesses to compete.

By Areyoukiddingme (anonymous) | Posted January 05, 2009 at 08:36:08

A Smith - "If the banks that over-leveraged themselves had been allowed to fail, the only thing that would have happened is that those who survived would have gotten bigger. Smart banks would have replaced stupid banks."

Yea because that worked so well between 1929 and 1933 :P learn some history before spouting anymore.

By Jonathan (registered) | Posted January 05, 2009 at 09:54:49

"Ryan, where do most of the new, most innovative companies come from? It's not Germany or Japan, but the U.S.A.,"

Sorry but that's just too ridiculous to leave alone. The US car industry has profited almost exclusively from body on frame construction cars and truck derived vehicles for decades after that technology was obsolete. All the while they have been importing and reselling Asian vehicles to meet average fuel economy standards.

By jason (registered) | Posted January 05, 2009 at 10:02:09

Am I the only one somewhat perplexed at the statement that the most innovative companies are American?? Or, that the best technology is from the US?

The auto industry is just one example where that isn't true. Go research the cell phone/camera/gadget industry and look at how far behind the US and Canada is compared with some other places in the world.

By jason (registered) | Posted January 05, 2009 at 10:02:44

oops, sorry Jonathan, just saw your comment. LOL.

By Brandon (registered) | Posted January 05, 2009 at 10:36:04

A Smith,

Do you really believe it was regulation that caused the problems? A huge part of the problem is "Credit default swaps", which are, essentially, insurance without the pesky government rules restricting them. In order to insure something, you need to prove you have a certain amount of capital. This is to make sure that you don't insure more than you can reasonably cover. I know, I know, stupid rules.

But let's see what happened. A whole pile of risky mortgages (again, lack of rules allowed them to come into being, but that's another story) were bundled with decent mortgages and given triple AAA ratings (more rules gotten around there...) and sold as safe investments. Those were then re-bundled again and again. Now we have a combination of these sub-prime mortgages resetting to higher interest rates and the housing market leveling off instead of continuing to rise. Hello mortgage defaults.

Now about that insurance that was promised... What do you mean you can't cover it?

Suddenly it turns out that a lot of these regulations had a basis in fact, not simply some absurd desire to stop people making money.

Who won from these deregulations? Why, the people making millions upon millions at the top of Wall Street with their lobbyists and tame legislators. Who lost? Millions of people who were convinced by predatory lenders that their housing prices would continue to rise indefinitely and so re-financing would always solve their problems.

Rules are not, by definition, bad things.

By A Smith (anonymous) | Posted January 05, 2009 at 14:28:09

Areyoukiddingme, what's your point? Banks failed in those years because the economy tanked. Since fractional banks use large amounts of leverage, when the economy shrinks, it sets them up for huge losses. The government helps promote this system by issuing deposit insurance, which gives depositors the false impression that their deposits, which are actually investments in people's homes and businesses are somehow safe from the real world. Therefore , the government has promoted a banking system where risk taking is encouraged, since the people who supply the capital feel it is not at risk.

Jonathan/Jason, I didn't say the U.S. auto industry was the most innovative, I said that the overall U.S. economy has been. Think about who "invented" the internet, the airplane, the car industry, the cell phone, satellite T.V., satellite radio, private space travel, etc. Your point about cell phone/gadgets only reinforces my point that other countries are second tier adopters of this new technology. Of course, they add their tweaks to existing breakthroughs, but the fact remains that the dynamic U.S. economy creates them.

Brandon, regulation and rules are only helpful if the deliver as much as they promise. Otherwise, all rules do is allow people to let their guard down, thus making it easier for shady business operators to take advantage of them. With regard to rising home prices, I find it interesting that the government didn't recognize that an average 10% increase in home prices was not inflationary. If they couldn't or wouldn't see that obvious fact, why should anyone put any trust in these people to protect any other parts of the financial system.

The fact is, governments love making big promises, but they also have a long track record of under delivering. I would much rather have a government that promised very little, thus allowing individuals to do their own homework before investing.

By A Smith (anonymous) | Posted January 05, 2009 at 16:43:41

Ryan, show me the evidence that supports your assertion that government regulations support innovation.

By Brandon (registered) | Posted January 05, 2009 at 21:08:53

A Smith,

You've had eight years of American gov't that were firm believers that the gov't was the problem, not the solution. This is a decided advantage that conservatives have over progressives. They get into power, refuse to do anything and when everything goes south, they shrug their shoulders and say "See, gov't is bad!".

How can individuals do their homework if there are no rules in place to frame what they're reading? You can't go to the factory and see what they're building. You can't go to the software company and ask to see their sales records. All you can do is go by what they tell you in their annual reports. Things that they are required to tell you. Who makes those rules? Who enforces those rules?

Are you trying to tell me that only foolish people were caught by Bernie Madoff's investment program? Or that only suckers invested in Enron? If you lie, you can make your Financial Statements say what you want them to say. Who's going to catch the liars if not the gov't? The gov't will never catch them if the people in charge are firmly against the idea of enforcement, which leads us to where we are today.

Or are you suggesting that you're a canny enough investor that, in your spare time, you can figure out what companies are really good and which ones are frauds? If you can do that you'd probably make a lot more money working for the SEC.

By Grassroots are the way forward (registered) | Posted January 05, 2009 at 22:44:18

Brandon writes: The gov't will never catch them if the people in charge are firmly against the idea of enforcement, which leads us to where we are today.

I think people need to analysis, who and what is the government? We like to think or believe that the government has the people's best interests but in light of current events, well it leaves me wondering.

It seems more and more that those who have power and money seem to dictate to the rest of us, the people are losing their voice, they are being drowned out.

I watched a video last week about a young fellow and a police officer. Very scary stuff if you ask me, to know that there are police officers like this one out there, who, it seems can do whatever they want, no rules, no justisfication for the very aggressive behavior which in my mind was very unwarranted.

Rules, there doesn't seem to be any rules for those who have the power.

By A Smith (anonymous) | Posted January 06, 2009 at 11:16:20

Brandon, I lost 20K in a stock that turned out to be a complete fraud. This stock was listed on the NYSE, so I assumed that the numbers, even thought they reflected the past, were enough of a buffer to allow me to get out if the company's fortunes spiraled down. The problem was, the numbers were imaginary. Somehow the regulatory structures set up by the government to give investors like myself confidence, only served to drop my guard and my gut instinct.

I remember thinking that something wasn't right after a couple of months, but I also remember thinking that this couldn't be the case, because the balance sheet was all on balance, no off balance shenanigans like Enron. The problem was, the government couldn't even guarantee the truth about what they had in their company bank accounts. Where the company said they had $250M in cash, there was probably $250.

Abolish regulations, make investors more responsible for their investments and you will likely see much greater transparency in all financial markets. When investors realize that there is no one out there to protect them but themselves, they will demand much greater access to a company's inner workings. If companies need capital, which they always will, they will have to do much more than the minimum the government requires of them today. If they don't give investors this insight, they will not get the capital.

By Brandon (registered) | Posted January 06, 2009 at 12:03:00

Or, you could support a government that doesn't cut down on the number of audits of big businesses. I know, I know, crazy thought.

If you eliminated all the rules, you'd essentially kill the vast majority of investment dollars. Who but the independently wealthy have time to truly assess the accuracy of firms statements? Do you really believe that you have the time and the skills to do this? Would you be willing to invest in a free for all market?

With more government sponsored independent audits of public companies, fraud will decrease, which means your 20k would have been safer.

It's not enough to have rules, you need to have people to enforce the rules. Ideally not hired from the companies upon which the rules will be enforced, which was a favourite tactic of the Bush administration. And people are shocked when things go wrong....

Deregulation is what got us where we are today.

By A Smith (anonymous) | Posted January 06, 2009 at 15:04:35

Brandon, why would I support a group of individuals that has already cost me 20K? They have proven they are not up for the job, as the recent $50B dollar fiasco makes clear. I don't care whether this is because they don't have enough auditors, or whether they are simply stupid, they have failed and that's all that matters in the real world.

In the meantime, I just assume that they will fail to live up to their promises and make all my investment decisions based on this assumption. I recommend the same thing for anyone else that currently looks to government to be their saviour, because in the long run they always do.

By Don't Forget (anonymous) | Posted January 07, 2009 at 10:15:22

Ryan you missed the single biggest reason for U.S. innovation, the supermassive U.S. industrial policy disguised as military defense. The govt plows trillions of dollars into so-called military R&D that's totally responsible for commercial aviation, computing, electronics, biotech, you name it. Free market my ass, A Smith doesn't know what the hay he's talking about.

By A Smith (anonymous) | Posted January 07, 2009 at 10:23:57

Ryan, no one is stopping you from putting your trust in government to protect your money, but my experience tells me this is dangerous. What I recommend instead, is to assume that they don't exist, thereby putting the burden on the individual to do more investigating before they invest. This can only help the average investor make wiser decisions, so I can't imagine you have a problem with that.

As far as education goes, I have looked a lot of numbers and have failed to come up with a correlation between education spending and GDP growth. For example, there are many states such as Michigan, Indiana, Wisconsin, Maine, Rhode Island and Vermont that spend above average on public education and yet have very poor growth rates. In contrast, there are states like Texas, New York, California, Washington, Colorado

By A Smith (anonymous) | Posted January 07, 2009 at 10:41:41

Continued from above...

and Louisiana that spend less than average and yet much faster growing economies. Similarly, there are countries like Greece, Brazil, Ireland and Russia that have been growing extremely fast with much lower education spending than the slow growing countries of Western Europe.

Furthermore, the innovation hotspots you mentioned earlier, such as Boston and Silicon Valley, are anchored by strong private universities such as Harvard and Stanford which have strong relationships to the venture capital industry. It is this flow of ideas and money from private individuals that bring ideas to market that is unique to the U.S.A.

I will grant you that having a literate populace is likely crucial to having a livable society, but this does not mean that government has to monopolize the education sector. The government could provide much greater choice and competition by providing vouchers. Since most people recognize the benefits of competition to the consumer in all other areas of delivery of goods and services, why don't we have that for our children today?

By A Smith (anonymous) | Posted January 07, 2009 at 10:48:58

Don't Forget, I have been making that same argument for months now, so I'm not the one who needs convincing.

By Brandon (registered) | Posted January 07, 2009 at 13:40:28

A Smith,

I'm curious. What tools do you use to determine what companies you should invest in?

By A Smith (anonymous) | Posted January 07, 2009 at 14:13:16

Don't Forget, I agree with you that military spending is preferable to things like public health and education, but even more important is a strong private consumption element to the economy, unless you want to end up looking like North Korea.

Private consumption, which is based on price signals, pushes capital into activities where companies can make the most profits. Since profits are a sign of consumer demand, the free market ends up allocating limited resources in a way that maximizes consumer utility. In contrast, when government invests capital, it has no way of knowing how much their end products are in demand. Since anything that is given away for free, including public education, health and roads, will have infinite demand, the government has no accurate way of judging the true value of its capital investment.

Over time, those economies that allow government to waste limited capital on investments of unknown return, end up falling behind in the production of real output relative to other nations who rely more on individual consumption decisions. Since prices indicate relative value amongst goods and services, not taking advantage of this extremely beneficial tool means that capital deployment will be hit and miss at best. A prime example of this can be seen in the economic misfortunes of countries that have embraced central planning in previous decades and to a lesser extent today.

Therefore, the free market is the best way of maximizing innovation as well as consumer satisfaction. Since there is simply no way a small group of people can understand the wants and needs of millions of people any better than they can themselves, the best way to increase real wealth is to let individuals make the spending decisions and not politicians. By doing this, you ensure that limited capital is always invested in the most profitable goods and services, which equates to what people are demanding the most. Anything else, is a waste of capital, since the free market puts zero restrictions on what it is that they will produce in order to meet consumer demand.

By A Smith (anonymous) | Posted January 07, 2009 at 14:47:36

Brandon, I still use the reported numbers, under the assumption that most companies are not outright frauds, however, I tend to listen to my gut more than I would have before. I think in most cases, the reported numbers are basically correct, but I think the threat of criminal prosecution could have as much to do with that as monitoring by the S.E.C.

I don't think you can go wrong, however, in doing as much investigative work into the company as you can. Off balance sheet items are a huge red flag in my book, since they are essentially unknown liabilites and therefore limiting your exposure would probably be a good idea.

Furthermore, I like companies that I can understand, since you eventually get a feel for management and where the company is headed. Therefore, when the stock price dips, which it usually does, you have already made yourself an expert on the company's strengths and weaknesses. This is a huge advantage over the market, because they tend to drift from stock to stock based on emotions.

Lastly, try to stay away from the mindset of playing it safe. That's exactly what I did when I purchased the stock that cost me 20K. I thought it was a conservative company to invest in and it turned out to be the complete opposite. I always talk about balance and I think that's part of the reason why this stock blew up on me. Since that time, stocks that I have bought because they were fun and that made products I thought were cool, actually performed the best.

Therefore, in the end, I would tell you to assume that you will lose all of your money, but if you still want to invest anyway, pick companies you can have fun owning. I think the more fun you can have with it, the more good karma you will likely bring to the table and perhaps this will influence the outcome in a positive way. Life is about balance, so in trying to avoid the negative, I think we just attract it even more.

By Don't Forget (anonymous) | Posted January 07, 2009 at 15:08:04

A Smith, you're arguing that the U.S. has more innovation (debatable anyway) because of its relatively unregulated free markets. I'm saying the U.S.' level of innovation is largely due to it's government run industrial strategy. An industrial strategy the U.S. pretends it doesn't have by calling it "defense spending" instead. The U.S. is a cheater, it wants the benefits of an industrial strategy but without having to admit that that actually works better than an industrial strategy.

Also I don't agree that military spending is preferable to things like public health and education, first of all I think that's crap since most military spending is actually spending toward consumer R&D fed to companies that also make military products. Second of all I'd rather decouple industrial strategy from the military since the current system puts too much power in the hands of military corporations which are then big enough to influence the government to be more militaristic. Third of all look at the cost of building a car in the U.S. or in Canada, it's cheaper in Canada even though our taxes are a bit higher because the auto makers don't have to pay huge private health care costs for Canadian workers. That's why the automakers are still here instead of all in the Deep South.

By Don't Forget (anonymous) | Posted January 07, 2009 at 15:08:54

Oops, I should have wrote "The U.S. is a cheater, it wants the benefits of an industrial strategy but without having to admit that that actually works better than the unregulated free market."

By Brandon (registered) | Posted January 07, 2009 at 16:04:35

A Smith,

Where do you think that the threat of criminal prosecution comes from? Regulations, that's where.

Without regulations, you have absolutely no basis whatsoever to compare one company to another, as for all you know a company could be expensing their long-term debts to reduce their liabilities.

Regulations give us a common ground and make it possible to compare apples to apples.

Enforced regulation means that we have a chance of believing what we read.

By A Smith (anonymous) | Posted January 07, 2009 at 21:42:14

Don't Forget, in the early nineties, under Bill Clinton, military spending as a percentage of the economy decreased and yet the economy grew much faster than it had previously and has since. Conversely, under Bush II, military spending has expanded by almost 50%, with smaller increases in the areas of on health and education, , however the net effect has been to increase the size of direct government spending decisions within the economy, to the detriment of private spending decisions. Basically, more central planning and less decentralized individual consumption. In 2000, total government spending in the U.S. economy was 30.59% of GDP. Today, it comes in at 34.93%.

The result has been mass disappointment with the handling of the economy and markedly slower gains in real economic output. Therefore, unless you can show me some numbers that support your assumption that government spending on the military is better than leaving that money in the hands of consumers, I will have to disagree with your line of thinking.

Brandon, criminal prosecution for fraud has nothing to do with regulating financial markets. Fraud can happen in any human to human interaction and therefore crafting financial regulations in order to prevent it is redundant at best. The threat of prosecution by itself is enough to keep most people from gong down that road anyway, but the cost of financial regulations to the investor is over confidence and that's why they probably cause more harm than good.

Ryan, there are many countries in the world with far higher growth rates, both absolute and per capita, which have governments that spend far less on things like public health, education and alike. Countries that come to mind are those that are currently switching from government based spending to private sector consumption.

These include China, Vietnam, Russia, Brazil, India, Bangladesh, and most of the countries of Eastern Europe. The main driver of these economic success stories has been the expansion of the private sector as a percentage of the economy. Furthermore, countries such as France and Germany which have very large public consumption models, bigger than North America, have very weak economic growth. The fact that they are already rich does not mean they got that way by having the government make most of the spending decisions. The welfare state has been a product of increased wealth and not the cause of it.

By A Smith (anonymous) | Posted January 08, 2009 at 00:17:06

Ryan, I disagree with you that moving from subsistence farming to a factory job is a step down the economic ladder. Otherwise, why would so many people from rural China be doing it today? Nevertheless, I agree with you that it sucks relative to the choices we have in Canada. If you want to help these workers, however, the best way is to increase capital investment and that means opening up trade as much as possible.

I agree with you that there is greater income disparity in the U.S. then most Western European countries, however this is because the rich carry an overwhelming share of the tax burden in the U.S.. In fact, ever since marginal rates have dropped from 91% to the current 35%, the average person has contributed less and less to government coffers. I think this has to do with the fact that as tax rates drop, rich people find it easier to simply pay their taxes, rather than spending money on hiring lawyers to get around them. However, because you tend to get back what you contribute, the rich also seem to benefit the most in terms of added wealth and opportunities.

I believe that if tax rates were increased to 50% or even higher, you would see income disparity drop over time. The funny thing is, you would also likely see the average person carry a heavier share of the tax burden. Therefore, I am not against raising marginal tax rates, because I agree with you that it would likely be a great way to help the average person.

Furthermore, of all the spending that government does, I think cash transfers to individuals is the least harmful to the economy and probably has zero effect on limiting growth. The only problem I can see is on the individuals who rely on for the long term. Therefore, I still think a job is preferable over handouts.

As to your 2007 growth stats, I find it interesting that many of the countries that show strong showings have also cut corporate rates in recent years. In fact, countries like the Netherlands have rates 10% lower than North America. Germany has also recently cut corporate rates, as has France. By allowing corporations to keep more of their income, the government makes it more likely they will invest. More private investment equals better tools for workers, which ultimately translates into better earnings potential.

Your last point about the boom years is dead on, except for your characterization that I don't agree with you. The thing about those years, however, is that the difference between what people paid in taxes and what they got back in social services was much greater than today. In fact, people used to get back only 85-90% of what they paid in taxes because much of the money was spent on things like missiles and overseas adventures. Today that gap is only about 2%, which means that people get back almost everything they pay in taxes and some people get more than they pay in taxes.

Furthermore, even though tax rates were higher in those years, tax collections as a share of the economy was much lower. In 1960, for example, all taxes paid to the government was 25.95%. Today with much lower rates, that number is 30%.

Therefore, the only thing that matters is what works. Judging by your arguments in this post, I don't think we are that far off from agreement. Perhaps through better analysis we can find methods that benefit all people, not simply the rich as has been the case in recent years and is becoming more so in Canada today. This requires willingness to bend to the truth, no matter how much it goes against each one of our established beliefs.

By Brandon (registered) | Posted January 08, 2009 at 11:05:45

A Smith,

Financial regulation would have prevented this credit crisis. What caused it? A little thing called a Credit Default Swap (CDS). What is this? "Insurance" without the bother of insurance regulation, which requires a certain amount of capitalization based on the amount of insurance that you offer. You know, so that you can actually pay out a significant portion of what you've guaranteed that you can.

How did things go wrong? Well, they were unregulated, so there were no limits to what they could "insure". What happened? Well, Lehman Brothers got a margin call of $20,000,000,000 due to the sub-prime mortgages going bad. For some strange reason, they couldn't pay up and so went down (wouldn't have anything to do with the former CEO of their main competitor being Treasury Secretary). That led to the current problem, which is that banks will no longer lend to each other either overnight or over the weekends, thus they have to keep more capital in-house, which means they can't offer it to you and I the way they would have before. Why won't they lend to each other? Well, they have no way of knowing if the bank they lend the money to will be around tomorrow. Kind of puts a damper on the desire to lend...

How did AIG get involved in this? Well, they dabbled in CDSs to the tune of about $440,000,000,000. How did they get there? Well, insurance regulators refused to let financial regulators into their turf, yet they didn't have a clue as to what they were looking at, so they ignored it.

If AIG had gone under, that $440,000,000,000 would have wiped out thousands of businesses, instead of just the few that have gone under.

How did these CDSs come about again? Oh yeah, because insurance regulations were too restrictive. The companies needed more freedom to make money, so they got around them. Can you honestly argue that it's been a net positive?

By A Smith (anonymous) | Posted January 08, 2009 at 11:52:31

Brandon, I understand your call for greater regulations and enforcement, but as an investor, how do you know that this is taking place. I was under the assumption that the numbers I was looking at were correct and yet they were not. How was I to know what that the government was doing? Who was watching them?

Furthermore, a big reason why financial companies made so many bad loans was due to the fact that money was too cheap. Since the BLS uses owner's equivalent rent in producing it's inflation numbers, rather than actual home prices, most of the increase in home values was illusory, based on nothing more than an expansion of the money supply. Had the government used median home prices in it's figures instead of OER, there would never have been 10% increases in home prices, but more like 2-3%. This would have allowed banks to slowly increase and decrease their balance sheet and not be whipped saw by a massive deflation that is now also understated in the U.S. economy.

Once again, reliance on inaccurate and incompetent government officials have led investors to let their guard down, thereby doing more harm than if they never existed in the first place.

Google "How owner's equivalent rent duped the fed" for a great primer on this subject. I think it will help explain why having zero government assistance is better than having inaccurate government assistance.

By Brandon (registered) | Posted January 08, 2009 at 14:39:40

A Smith,

The first step is in avoiding electing those who are determined to prove that government doesn't work, for reasons that one would think are obvious.

As an example, you have an SEC who had credible evidence from eight years ago that some guy named Madoff was running a ponzi scheme, yet no one looked at it. Nothing of course to do with the idea that enforcing regulations was bad for business of course...

Even Greenspan has come to the realization the "free markets" don't work.

As far as why bad mortgage loans were issued, I don't know enough to comment intelligently on it, however my guess would be that deregulation was involved somehow.

By A Smith (anonymous) | Posted January 08, 2009 at 15:41:40

Brandon, how do you know who these people are? Enron blew up under the Democrats, as did my stock and many others including Nortel, etc.

Perhaps the "good guy" party would be the ones to vote for. Unfortunately, they all tell us they are the good guys.

Greenspan worked for the government for over a decade, so he hardly a champion of free markets to begin with, no matter what he tells the world.

As far as the bad loans go, you may want to learn about the role government had in encouraging over investment in the real estate sector, otherwise you are making conclusions based on nothing more than popular opinion. It may feel good to blame big bad business, but blinding yourself to the whole truth will only serve to harm you in the long run.

By Brandon (registered) | Posted January 08, 2009 at 17:42:05

A Smith,

I noticed that you conveniently deleted all references to CDSs, which are the root cause of everything that went wrong. That is your perfect example of people taking advantage of lack of regulation to make huge profits with no concern for long-term risk. If I could trust people to work for long-term gains, I'd have no problem with deregulation. As it stands, most people only see short term gains and are willing to sell the world up the river to get it.

Many companies are too good to be true and there will always be investment bubbles. Keep in mind that brokers get paid for the trades, not for the success of the stocks that they sell. A huge part of how Enron happened was due to deregulation of the California power market though.

As far as the bad loans, I know that I don't know enough about it, in fact I said as much in my previous post, which is why I don't offer anything but a highly qualified opinion on it.

By Grassroots are the way forward (registered) | Posted January 08, 2009 at 22:37:32

A Smith does have a point about the government. I mean look at all the bureaucracy we have, which basically does nothing. But then is it not those who lobby who have the greater power and set in motion policy changes which affects those at the bottom of the income scale in the worst way, yet those who are the elite walk away scot free.

Why should we tax dollars to people who do not have the interests of the people? Why should people pay taxes to people who demand over the top wages, benefits, pensions, yet deny the people their right to these things?

Who pulls the strings?????

By David (anonymous) | Posted January 12, 2009 at 16:26:45

The US is definitely where much innovation comes from, but it's the bowl of rice/day workers that make it profitable. What's Walmart's greatest secret of success? It's that very little news comes out of China to show the shoppers the sweatshop conditions from which their "low prices" come from.

Chrysler is done - finished. Their 53% drop in sales was even before the nationwide story from analysts who said there is no way they can turn it around - scaring more customers away. This is probably necessary, to give GM and Ford a survivable market share, although it still won't put them in the black.

This Depression is 3-minutes into a 5-hour movie, and it will probably be "L" shaped. We aren't sliding down the backside of prosperity created by debt, but rather it is collapsing under us. We won't have that mountain to crawl back up on. This happend in minutes, even if it takes months to be realized, such as the USA losing 73,000 retail outlets in the first 6 months of 2009 - all overbuilt on debt.

In a free market economy, the free market should decide. Gov't money just postpones the inevitable, with a loss in value of everybody's savings account.

The problem with cars isn't just that Walmart salaries are trying to support those of Unions, but that the cost of the car puts the loan terms so long that people are upside-down on the debt for the life of the car - stuck. If they try to trade-in early, the remainder gets rolled into the new car loan, and now they are REALLY stuck... After a couple times of this, the car companies have lost a customer for years. In a world of $29 VCRs, the B3 product, and cars generally, have simply become unaffordable.

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?