Today, after all the ink spilled on peak oil in the past several years, it's inexcusable for a newspaper report on high oil prices not to identify the culprit.

By Ryan McGreal

Published November 17, 2010

Gasoline $1.098 per litre in Hamilton

An article in today's Spectator on high gasoline prices in Hamilton makes reference to the underlying cause without actually naming the culprit.

Jason Toews, co-founder of price comparison site GasBuddy.com, said the escalating cost of crude oil is largely to blame for the numbers consumers are seeing at the pumps.

"It's harder, more expensive and more costly to get crude oil now, and that's pushing prices up," he said. "Gone are the days when it just bubbled out of the ground."

If only there were a recognized name for the phenomenon in which the production of cheap, easy-to-reach oil peaks and goes into decline, creating a geological situation in which it becomes prohibitively difficult to continue increasing the rate of production.

In fact, the world has been in a state of peak oil production for more than five years now. Consider the following chart.

The green line is global daily oil production by month, starting in January 2000. The red line is global daily oil consumption by month. Production and consumption are both in millions of barrels per day (mbpd) and are pegged to the scale on the left Y axis.

The blue line is the average WTI spot price by month. It's in US dollars and is pegged to the scale on the right Y axis.

Notice that the red and green lines track each other closely from 2000 until 2006-2007, at which point consumption starts to outstrip production.

During the period from mid-2007 through mid-2008, demand (consumption) significantly outstrips supply (production). Oil inventories go into decline to cover the shortfall, and the price skyrockets from $60 per barrel to $147 per barrel as the marginal cost to produce an additional barrel becomes prohibitive.

After mid-2008, aggregate demand collapses due to the excruciatingly high price - timing that correlates very closely with the onset of the recession - and the price collapses with it, back to $40 per barrel.

What is abundantly clear from the data is that demand steadily outstrips supply starting in early 2007 and that the oil price, in keeping with introductory economics, rises in response.

It is also clear that the supply cannot increase to meet the rising demand, even as price signals to increase production skyrocket.

It is also clear that the prohibitive cost of oil in mid-2008 is what triggered the generalized crash in demand that characterized the latter half of 2008 and continued well into 2009 before demand finally started to recover.

I'm not aware that the data permit any other plausible explanation. In any case, I cannot think of one and have not seen anyone else present one.

Blaming the housing bubble for the collapse confuses symptom with cause. The housing bubble was able to continue expanding as long as the economy continued growing - but something had to put the brakes on further economic growth.

That "something" was the spike in oil prices, which in turn forced an increase in the cost of every good and service that consumes oil as part of its manufacture or delivery.

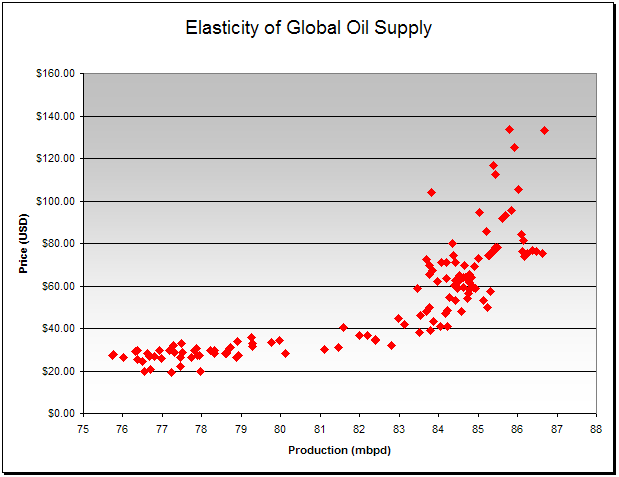

We can look at the data another way to arrive our conclusion. If we plot production against price, we get a price elasticity graph.

Elasticity of Global Oil Supply (Source: EIA)

This chart plots production (in mbpd) across the X axis against the price at that production level along the Y axis. This tells us the price elasticity of supply for oil.

In economics, price elasticity is a measure of the extent to which production can increase to meet rising demand. If the supply is elastic, increased production is associated with a very modest increase in price.

Elastic supply(Image Credit: Investopedia)

If the supply is inelastic, that means increases in production are accompanied by sharper increases in price.

Inelastic supply (Image Credit: Investopedia)

Now look again at the supply elasticity graph for global oil production. As you can see, supply is elastic up to around 83 million barrels per day. It's a classic elastic supply curve.

From 84 mbpd on upward, supply becomes decidedly inelastic, following a classic inelastic supply curve.

This is precisely what peak oil theory predicts: beyond 84-85 mbpd, the marginal cost to produce an additional barrel of oil starts racing toward prohibitive. The data overwhelmingly bears this out.

We are in peak oil, and have been for several years. The very high price of oil (and hence gasoline) we're experiencing today, in mid-November as the global economy crawls out of the sharpest recession in 70 years, is directly related to recovering demand after the recession bumping up against tight supply.

How a journalist managed to write an entire article about high oil prices that actually quotes an energy analyst describing peak oil - but neglects to point out that the phenomenon being reported is well-understood, exhaustively researched, strongly supported by empirical data, and has a name - is beyond me.

Three or five or eight years ago, this gross oversight would have been more understandable, if still an unfortunate missed opportunity to introduce readers to an important concept. Today, after all the ink spilled on peak oil in the past several years, it's simply inexcusable.

(h/t to Jason Leach for pointing out the Spectator article.)

By allantaylor97 (registered) | Posted November 17, 2010 at 11:11:03

Comment edited by turbo on 2010-11-17 10:15:21

By jasonaallen (registered) - website | Posted November 17, 2010 at 11:20:41

Thanks Ryan - I saw that article in The Spec this morning and it put my teeth on edge. There seems to be a feeling among people that if we don't talk about the Trifecta (global warming, peak oil, and record sovereign/personal debt levels) that everything will just...kind of muddle through. Interestingly enough, both the Globe and the National Post have at some point in the last year or so 'called a spade a spade' and used the "P" word. Awareness and willingness to have the discussion is sloowwwwllly catching on, but unfortunately at this point it's a race against time.

By seancb (registered) - website | Posted November 17, 2010 at 11:30:51

...and only spans 10 months? It is fairly irrelevant I think:

adding the second one:

Comment edited by seancb on 2010-11-17 10:34:14

By allantaylor97 (registered) | Posted November 17, 2010 at 11:31:33

Comment edited by turbo on 2010-11-17 10:32:42

By seancb (registered) - website | Posted November 17, 2010 at 11:36:11

Look at the ranges - the first, 57-80 the second 67-90

You have to zoom out. You can't look at a single year and make assumptions and predictions into the future unless you only want to predict a few weeks or months...

By MattM (registered) | Posted November 17, 2010 at 11:36:14

It's kind of pathetic that the media keeps telling the same story about this one: "Gas is expensive guys, so you might want to lay off the designer clothes and consider not driving the kids to soccer practice as much... but don't worry, it'll get better and soon you'll be back to your regular routine of convenience and mass consumerism!"

People bitch and whine about it, but don't question it. At most they consider purchasing a hybrid vehicle, mostly just so they can say they did. Even still though, they use that hybrid car to do all the unnecessary crap that they always did anyway.

It's easier to whine and bitch when your routine gets harder, instead of adapting and making changes.

Comment edited by MattM on 2010-11-17 10:55:34

By Jonathan Dalton (registered) | Posted November 17, 2010 at 13:50:35

I hate the fatalistic attitude most people seem to have (I.e. 'grin and fill it'). The price of gas broke $1/litre in the summer of 2006. I remember the shock and surprise. In the 4 years since, I've gradually adjusted my habits while other people keep complaining. Now I spend $0 per month on gas. It took me a while to get there but it isn't that hard. Nobody can change their driving habits overnight but seriously, we've known about the reality of higher energy costs for many years. Those who don't begin to adapt are only making fools of themselves.

By allantaylor97 (registered) | Posted November 17, 2010 at 13:54:45

Comment edited by turbo on 2010-11-17 12:57:22

By adrian (registered) | Posted November 17, 2010 at 14:15:48

I'm pleased to announce that the bookmarklet I developed which hides all of Turbo's comments now works in Firefox and Internet Explorer as well as Chrome.

If the prospect of hiding (and downvoting) all of Turbo's comments with one single, satisfying click appeals to you, then:

By B'Gosh (anonymous) | Posted November 17, 2010 at 14:28:14

Yep, thanks for finding a quicker way to sanitize unwanted comments by anyone who disagrees with RTH...you guys are the best. Damn the torpodoes, or at least damn free expression of contrary thoughts...that's what RTH stands for...Rid Those Heretics of any thought but ours!!!

Grand Inquisitor Ryan

By allantaylor97 (registered) | Posted November 17, 2010 at 14:31:53

Comment edited by turbo on 2010-11-17 13:33:32

By synxer (registered) | Posted November 17, 2010 at 14:59:13

@adrian - I actually laughed out loud when I read your blog post about this specific situation. Nice!

By bobinnes (registered) - website | Posted November 17, 2010 at 16:36:19

Ryan - I made some comments on your charts when you posted them previously but they were buried in the middle of other stuff. Could you have a look here

http://www.raisethehammer.org/article/12...

Also, your 1st chart does not look the same (seems more flat) and I'm wondering why that would be.

The elasticity chart is also being covered up by the articles list so for those having oddball browsers like me (SeaMonkey) you can follow that link and scroll up the page to see the chart properly.

But I'm a bit surprised at your reaction to the non-Spectator - what else did you expect? I gave up on that rapacious rag many moons ago. It is not in their interest to educate their readers. Money is all they understand. With RTH & the Hamiltonian, what more do we need? We just have to hope the sheeple will eventually clue in.

Comment edited by bobinnes on 2010-11-17 15:47:07

By Mark-Alan Whittle (anonymous) | Posted November 17, 2010 at 17:04:55

GM has made an amazing recovery. Every 100 years the worlds population turns over and expands. Sooner or later scientists will minituraize a nuclear reactor to power cars, or personal transportation devices. I hardly use my car anymore, but my wife still works, 20 minutes by car or two ours by bus or $30 bucks for a cab ride. Hardly living large, IMHO. Canada is unique, we produce ethical oil, that's the gas I buy at the pump.

By Undustrial (registered) - website | Posted November 17, 2010 at 20:17:50

The GM recovery (err, bailout) would be a good example here.

If the automobile, as THE standard form of mass transit, then why are we having to bail out auto companies?. If cars are what the market wants, why so glum when the market changes its mind?

While the price of cars has plummeted, the price of bikes (and components etc) is rising quickly. Changes don't happen overnight, or in neat definable ways, but there's always evidence if you look around.

By bobinnes (registered) - website | Posted November 18, 2010 at 00:55:49

Hi Ryan. The best source for real inflation/unemployment/GDP data i'm aware of is

Once one lets this reality sink in, it changes 'everything', at least in the economics & political department. I no longer trust our officials to tell the truth.

The elastic thing is more of a consideration of marginal production. If in 1920, one wanted a little extra oil, there wouldn't be much penalty but if one wanted humungous extra, one would have to pay dearly. At any given point of time, production can't be increased immediately, absent idle capacity. Therefore prices would rise in proportion to the stress put on the then existing system in real time. WW2 might be the best example of this.

Whether we have reached peak oil exactly or not quite is of little interest to me as I believe we are about to be hit with a dollar crashing issue far sooner than an oil rising issue. It may be quite possible for us to see a rising nominal price while the Arabs or Chinese or Russians see a falling real price. Real as defined possibly by gold, the 5000 year old monetary system everybody seems to have forgotten about till recently. Such is the fruit of our profligate ways. As long as we insist on importing so many Chinese goods, we fuel up their drivers while hobbling ours, ie many Canadians will find it necessary to quit driving (so much) while Chinese enjoy their first car. China is now producing more cars and growing by something like 50% a year if that can even be imagined. So even if oil hasn't yet peaked, even if production rises a few %/yr, it wont make much difference to that kind of new demand. Somebody will use up all that fuel, it just wont be us unless we get a lot smarter - which is what we are all hoping for, yes?

By adam2 (anonymous) | Posted November 18, 2010 at 21:46:37

According to peak oil theory, we would see drastically higher prices at the supermarket, and gasoline prices that are 3 or 4 X what they are now. I remember 25 years ago the price of gas was $0.70/L, a jump up to $1.10/L isn't much higher after accounting for inflation. Once we see $5/L or higher then I'll agree that we are in peak oil.

By Ted Mitchell (registered) | Posted November 18, 2010 at 23:02:31

Excellent graphs Ryan, especially 'elasticity of global oil supply'.

I think that the discussion about whether we are in peak oil or not misses the bigger question the first graph suggests: how elastic is the economy in response to rising oil prices? Because of a heavily resource based economy, Canada has little ability to increase GDP/energy unit consumed, since we are in my reading of the data, the most uncompetitive of first world countries in this dimension. http://en.wikipedia.org/wiki/Gross_domes...

If Canada's economy is inelastically related to energy prices, that is we are unable to extract more dollars per barrel, what happens?

The test starts now to see if 2008 was a one-off or it will be like 'groundhog day' : as the economy picks up, if oil/gas prices spike up even more quickly, will it trigger the brakes on the economy again? If so, then the sputtering could continue indefinitely if status quo economic management prevails. Soon, maybe within a decade or two, we could be unable to catch up with the rest of the world which can create more GDP per barrel.

By Ted Mitchell (registered) | Posted November 18, 2010 at 23:27:23

@adam2, in 1986 I pumped a lot of gas, and recall the price in relatively expensive n. ontario was $0.43. can't find the unadjusted numbers, but this is corrected for inflation: http://www.fin.gc.ca/toc/2006/gas_tax-en... and u.s., europe: http://en.wikipedia.org/wiki/Gasoline_an...

By mossey man (anonymous) | Posted November 19, 2010 at 09:44:35

6969696969696I*

By highwater (registered) | Posted November 19, 2010 at 12:02:38

^This may not be spam per se, but I think it could be safely deleted without anyone being accused of censorship.

By allantaylor97 (registered) | Posted November 19, 2010 at 12:50:23

excellent post Ryan. Agreeing or disagreeing on theoretical peak oil production forcasts makes no difference to the truth of the effect of oil prices and the effect on our economy. It is particularity the last paragraph that I hold to although urban development is only a part of what we need to do to stay ahead of the curve. Developing alternate energy sources and increasing efficiencies of energy use in what is now deemed conventional transportation modes, heating lighting etc. is also key

By adam2 (anonymous) | Posted November 20, 2010 at 09:26:03

Here is a graph of world oil production from the International Energy Agency based in Paris, France. I think it supports Ryan's article. Notice the amount of oil "yet to be discovered" and "yet to be developed" makes up a sizeable chunk of the projected production of oil..(??!)

http://earlywarn.blogspot.com/2010/11/iea-acknowledges-peak-oil.html

By A Smith (anonymous) | Posted November 20, 2010 at 12:24:40

Ryan >> Perhaps the next stretch of years will be characterized by a cycle of events in which the oil price skyrockets as demand recovers after a recession, triggering another recession in a gradual ratcheting down of our material standard of living.

Economic growth is the result of investing in the future and not eating all of your crop in the present...

Net National Savings as % of Gross National Income

Great Depression

1929 9.3%

1930 6.0%

1931 -0.6%

1932 -7.5%

Post WWII Economic Boom

1950's 10.27%

1960's 10.85%

Late Nineties Boom

1995 4.7%

1997 6.7%

1999 6.5%

2000-09 average

2.25%

Net National Savings average under Obama

-2.02%

Without a shift away from borrowing/consumption and towards saving/investment, the U.S. economy will continue to perform under it's potential.

Here is a chart that shows the savings level of the three sectors of the economy...

http://www.taxpolicycenter.org/UploadedPDF/1000664_TaxFacts_062104.pdf

By Cityjoe (anonymous) | Posted November 27, 2010 at 17:00:20

I was going to agree with allantaylor 97 That every holiday gas prices jump, until I realized that it was poster suicide to do so. :)

I could even mention that every U.S. Thanksgiving (4th of July etc., etc.) the cost of gas goes up in Canada, even though we aren't going to Nonna's, or heading out to Black Friday sales. But that would be just WWWWRRRRRONG!

The cost gas will maybe never decrease, & still Hamilton has made no headway in LRT, or improved bus service to the Burbs or even within the City.

Soooo... what's a girl to do?

'Can't afford a new electric car. '[Can't afford a new car at all)

Move back to TO, where there is an efficient transit system? ('Can't afford that either!)

Have everyone in the house quit their respective jobs, thus eliminating the need to go anywhere.(Cuz we can't afford to go anywhere.)

Move to Westdale! (bwaahaahaaa) No.

By z jones (registered) | Posted November 27, 2010 at 17:33:27

Net National Savings as % of Gross National Income

All you've proven is that savings go down during a downturn/depression. BIG SURPRISE. Once again you confuse correlation with causality. Ask yourself, if saving was 9.3% in 1929, why did the Depression start at all? Why didn't savings rate start falling until after the Depression started? Actually scratch those questions. I'd rather you just stop posting for awhile and go learn how to think before coming back.

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?