If we take the stand that paying for a service gets you a vote and rebalance the votes to suit that notion, we come to a very interesting point of view.

By James Arlen

Published January 26, 2015

Every now and then, I watch Joey Coleman's ThePublicRecord.ca live feed of Hamilton's City Council and I'm reminded of a scene from Wingfield's Progress:

Setting: Persephone Township Council

Township Clerk: Your Worship, the first item of business is a letter from Demeter Township saying they don't want to contribute to the Larkspur Library Agreement anymore.

Reeve: What are they whining about now?

Township Clerk: Seems they've checked the records, found that no one from Demeter has used the Library in the past two years. They say it ain't worth it and they want out.

Councillor: Ain't had no fire up there this year either. They ain't askin' to get out of the Fire Agreement.

Township Clerk: Is it the wish of council that I write them back while they can still read and tell them to go to hell?

Last week, Hamilton City Council played its role with Academy Award precision to the standard set by (the fictional) Persephone Township Council. The latest embarrassment to the citizens of Hamilton: the parochial and naive vote to dismantle the King Street Bus Lane.

However, I think we've missed something very significant in the "Shaming of the Nine" tweets and articles. Something that Councillor Merulla brought up but did not chase to the logical extent necessary to drive the point home. Quite simply: "Money Talks".

One of the many quirks of post-amalgamation Hamilton is the notion of Area Rating. Put simply, different parts of the city contribute more or less of their taxation percentage to various civic services depending on the level of service they receive.

I'll even go so far as to say it makes a certain amount of sense. Most of Flamborough lacks sidewalks and streetlights; therefore, they shouldn't have to pay as much for those services as someone in Ancaster, where sidewalks through downtown are wide and well lit.

Where this plan falls apart is in the idea that different parts of the city contribute to the operation of HSR at different levels depending on notions around how much service they receive.

This topic has been discussed many times on Raise the Hammer with a couple of stand out articles:

From 2007, Time to End Area Rating for Transit:

The current area rating system charges the average ($179,000) home in old Hamilton $165 a year in HSR levy. This is almost exactly five times the levy imposed on the same value home in Ancaster ($34). The numbers for Dundas are $41, for Stoney Creek $53, and for the tiny part of Glanbrook that pays transit levies, it's $70 per average value household. Flamborough (including Waterdown) pays no HSR levy at all - and has no HSR service.

From 2011, Area Rating Presents Opportunity For Leadership And Consensus-Building:

On a home assessed at $219,600, residents in the old city of Hamilton pay $195 in taxes for transit, while residents in other areas pay far less: $62 in Stoney Creek, $42 in Ancaster, $46 in Dundas, $44 in Flamborough, and $83 in the part of Glanbrook that receives transit service.

And more recently on the excellent CATCH - Citizens At City Hall:

From 2013, Inner city taxed much more for HSR:

The average-valued home in old Hamilton is taxed $288 a year to support the HSR, while a similar-priced house in Ancaster pays just $71. The equivalent charge in Stoney Creek is $83, in Dundas $62, in Waterdown $50 and in Mt Hope $93 per annum.

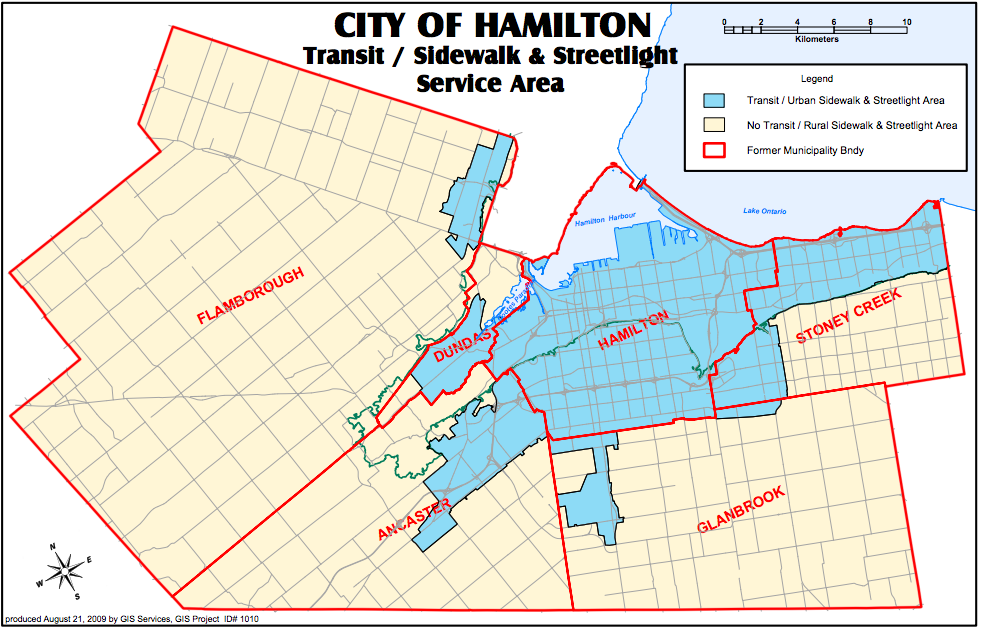

You can see how this system is laid out geographically using the City of Hamilton's Transit/Sidewalk and Streetlight Service Area map:

Transit/Sidewalk and Streetlight Service Area

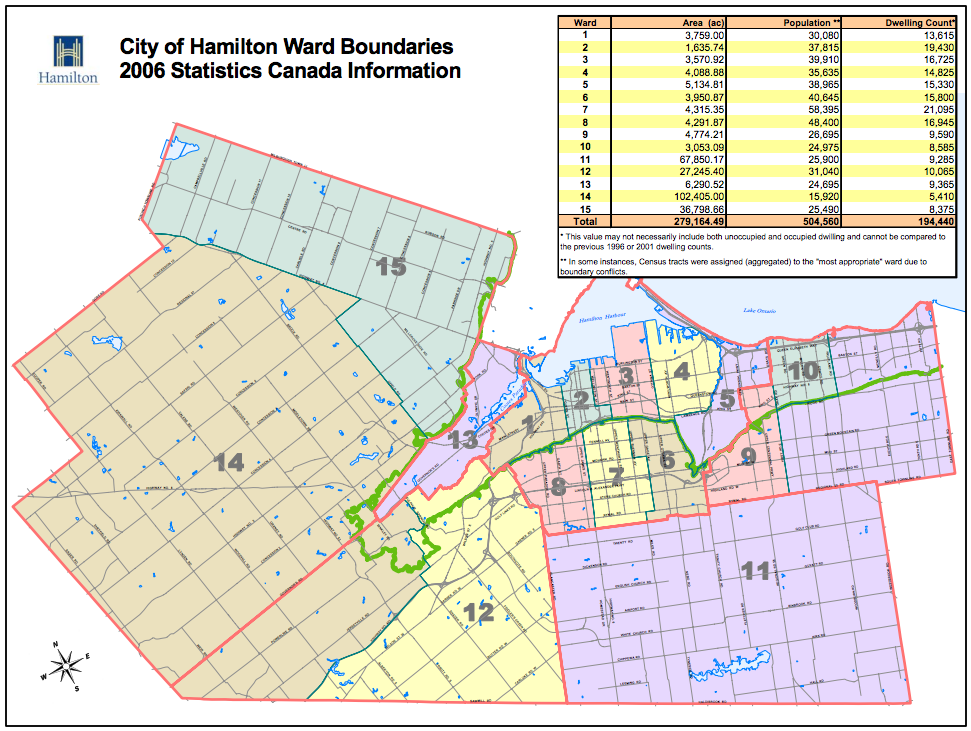

Although, you'll also need a Ward Map to keep it straight in your head:

City of Hamilton Ward Boundaries 2006 Statistics Canada Information

As you can see, the blue area representing the Transit / Urban serviced area is a relatively small proportion of the overall size of the City (wow, Hamilton is HUGE!) but the population of the blue area is also the majority of the citizens of Hamilton.

If you try and learn about Area Rating from the City website, the best you'll manage is some stale data from 2011 on a page titled "City of Hamilton - Corporate Services Area Rating".

Dig a little harder and you can find the "City of Hamilton - Residential General and Area Specific Rates By Community" [PDF] document from 2014:

| General Rates Applied to Entire City | Area Rates Applied to Respective Community | Total Residential Tax Rate | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Municipal | Provincially Shared Programs | Police | Education [1] | Transit | Fire | Area [2] | ||||

| Stoney Creek - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.026% | 0.131% | 0.063% | 1.290% | ||

| Stoney Creek - Rural | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.067% | 0.041% | 1.179% | ||

| Stoney Creek - Urban with Rural Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.026% | 0.067% | 0.063% | 1.226% | ||

| Glanbrook - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.039% | 0.131% | 0.060% | 1.300% | ||

| Glanbrook - Rural | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.067% | 0.039% | 1.176% | ||

| Glanbrook - Urban with Rural Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.039% | 0.067% | 0.060% | 1.237% | ||

| Glanbrook - Rural with Urban Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.131% | 0.039% | 1.240% | ||

| Ancaster - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.025% | 0.131% | 0.062% | 1.288% | ||

| Ancaster - Rural | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.067% | 0.039% | 1.176% | ||

| Ancaster - Urban with Rural Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.025% | 0.067% | 0.062% | 1.224% | ||

| Ancaster - Rural with Urban Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.131% | 0.039% | 1.240% | ||

| Hamilton - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.088% | 0.131% | 0.098% | 1.387% | ||

| Dundas - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.021% | 0.131% | 0.070% | 1.292% | ||

| Dundas - Rural | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.067% | 0.048% | 1.185% | ||

| Dundas - Rural with Urban Fire | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.131% | 0.048% | 1.249% | ||

| Flamborough - Urban | 0.477% | 0.187% | 0.203% | 0.203% | 0.014% | 0.131% | 0.060% | 1.275% | ||

| Flamborough - Rural | 0.477% | 0.187% | 0.203% | 0.203% | 0.000% | 0.067% | 0.039% | 1.176% | ||

| 1. Education tax rate set by the Government of Ontario. 2. Area includes Recreation, Sidewalks and Streetlights and, if applicable, Parkland Purchases, Sidewalk Snow Removal and Special Infrastructure Re-Investment |

||||||||||

As you can see, the contribution rates are in the column "Area Rates Applied to Respective Community" and include the variation for Urban (comes with Transit) and Rural (No Transit).

Hamilton pays more than twice the rate of the next closest (Glanbrook) and more than five times as much as the lowest (Flamborough).

If we even out the percentages to make them a little more comprehensible, we have the following:

That's right: for every $1 in property tax paid by a West Mountain resident in Ward 8 towards the HSR, an Ancaster resident in Ward 12 pays just $0.28. I'll let that sink in for a moment and don't forget that Ancaster Councillor Lloyd Ferguson owns four taxi cab plates while you're thinking about it.

The Areas are related to the pre-amalgamation municipal boundaries and therefore we have to puzzle out how much coverage each Ward has relative to the Service Area as well as the original municipality boundary (ie: Ward 11 - Glanbook covers an area of what was the Municipality of Stoney Creek).

Without better access to GIS data of population distribution and something other than Mark 1 Eyeball to figure out areas, I've assigned the following 'serviced areas':

If we take the stand that paying for a service gets you a vote and rebalance the votes to suit that notion, we come to a very interesting point of view.

With the exception of Brenda Johnson in Ward 11, who voted for the transit-only lane, there are four councillors who voted against a Transit issue who have very little skin in the game.

If you use the area rates and percentage serviced numbers from above, you can calculate a "Weighted Vote Value":

If you pay 100% for HSR service and you have 100% service coverage, you get *one* vote. If, on the other hand, you pay 24% for HSR service and have 50% service coverage (Hi Dundas!), then you get 0.12 of a vote. It's a vote proportional to your 'skin in the game'.

Despite the lack of a promised citizen engagement on LRT/Transit, we'll let Mayor Fred keep his vote.

The original vote to keep the bus lane was: 7 for and 9 against.

The weighted vote to keep the bus lane would be: 5.36 for and 5.21 against.

Now, this is a strongly simplified argument. Improvements in transit are a great example of city building where rising water lifts all boats. Then again, the arguments against the bus lane were simplified too.

Below, you'll find the table with actual numbers. I'll leave it to others to think about how Area Rating continues to hurt the City of Hamilton at the expense of political grandstanding.

As for me - the bio says it all: Infosec geek, hacker, social activist, author, speaker, and parent. I'm going to keep working for a Hamilton that is ambitious and really is "The Best Place in Canada to Raise a Child".

| Area | Name | Keep Bus Lane | % HSR Service | Area Rated Transit Tax (adjusted) | Weighted Vote For | Weighted Vote Against |

|---|---|---|---|---|---|---|

| Mayor | Fred Eisenberger | Y | 1.00 | |||

| 1 | Aidan Johnson | Y | 100% | 1.00 | 1.00 | |

| 2 | Jason Farr | Y | 100% | 1.00 | 1.00 | |

| 3 | Matthew Green | Y | 100% | 1.00 | 1.00 | |

| 4 | Sam Merulla | Y | 100% | 1.00 | 1.00 | |

| 5 | Chad Collins | N | 100% | 1.00 | 1.00 | |

| 6 | Tom Jackson | N | 100% | 1.00 | 1.00 | |

| 7 | Scott Duvall | N | 100% | 1.00 | 1.00 | |

| 8 | Terry Whitehead | N | 100% | 1.00 | 1.00 | |

| 9 | Doug Conley | N | 100% | 1.00 | 1.00 | |

| 10 | Maria Pearson | Y | 100% | 0.30 | 0.3 | |

| 11 | Brenda Johnson | Y | 15% | 0.44 | 0.07 | |

| 12 | Lloyd Ferguson | N | 25% | 0.28 | 0.07 | |

| 13 | Arlene VanderBeek | N | 50% | 0.24 | 0.12 | |

| 14 | Robert Pasuta | N | 0% | 0.16 | 0.00 | |

| 15 | Judi Partridge | N | 10% | 0.16 | 0.02 | |

| Total | 5.37 | 5.21 | ||||

Anyone else want to get ready for the next challenge and the next opportunity?

By RobF (registered) | Posted January 26, 2015 at 10:14:52

Great analysis and explanation of area ratings. I'm familiar with this sort fiscal configuration and knew it applied to Hamilton, but have never seen it explained so clearly.

Useful info next time transit is discussed at council.

Now if we could get an analysis that breaks down assessment per ward, especially total, per acre, and the ratio of non-residential to residential, then we'd really be getting somewhere in terms of having a grown up conversation at city hall.

By Marc Risdale (anonymous) | Posted January 26, 2015 at 11:07:05

Very interesting analysis. It would also be interesting to overlay average assessment data. While houses of "similar" value in different wards pay relatively different amounts for transit, the average assessment values in the wards vary widely. So in absolute terms, many tax payers in the 'burbs (hello Dundas!) pay quite a lot of "absolute" money for 50% coverage by HSR.

By RobF (registered) | Posted January 26, 2015 at 19:48:58 in reply to Comment 108393

You need to consider assessment per acre (or some equivalent). Our houses and lots are not equal. I live on a row of 7 houses that all are on roughly 24' by 105' lots. I believe a more common frontage in suburban Hamilton typically 50' and up.

That makes direct comparisons between the two less than straightforward. Two of our "inner city" houses may occupy the same frontage as the average suburban house. Of course, in my area frontages range from 15' to 35' (maybe 40', but these are rare). In suburban areas the frontages can be quite a bit larger too, while in some older areas may be somewhat below 50'.

You also have to consider uptake of services ... it depends on how many people live in each dwelling and how much demand they put on services/infrastructure (particularly schools and roads).

Furthermore you need to consider non-residential assessment, which are generally significant net contributors (pay more than what they cost).

In my area, Ward 2, we have a lot of non-residential assessment, so comparing our tax contribution to the city vs. Ancaster, Dundas, Waterdown, etc. would be foolish ... we'd win hands down. The question is what generates that assessment ... most non-residential assessment relates to demand or activity that isn't purely neighbourhood-related.

In short, it would be interesting to see assessment breakdowns by Ward. I think people would be surprised by the results.

Comment edited by RobF on 2015-01-26 19:50:03

By myrcurial (registered) - website | Posted January 26, 2015 at 11:51:15 in reply to Comment 108393

I agree it would be interesting, but that drives right down into the 'economic status = right to preferential treatment' -- I think as a city, it is incumbent upon us to treat all issues as a "one resident = one right" -- that I live in Ward 4 (and used to live in Ward 3) and choose to live in a house with a lower assessed value than the average in Dundas, does that increase or reduce my right to representation?

Also, in absolute terms, I doubt that the increased average assessment in Dundas is four times that of the average assessment of Wards 1-9. Remember, area rating is a twin-bladed sword - If a Dundas person pays $1 in HSR Area Rated Property Tax, as a Ward 4 resident, I've paid $4.17.

There's not a quick-to-find resource for assessments, but we can use average home sales price as a yard-stick (see this image from Hamiltonhomes-for-sale.com -- http://www.hamiltonhomes-for-sale.com/ac... and this article for the price in Dundas: http://www.hamiltonhomes-for-sale.com/Du...

We'll pick on the examples of Dundas and where I live in Homeside (Kenilworth & Main)

Average Sale Price - Dundas: $355,891 Average Sale Price - Homeside: $172,593

Looks like the average price here is a little less than half that of Dundas - 48.5%

Logically, this means that the Dundas average homeowner pays (in absolute dollars) about twice what I do.

And that also means that for every $1 I contribute to the HSR, the Dundas resident - taking into account the higher assessment - pays $0.48.

So in absolute terms, they don't pay more than I do, not even close. But they do pay for about as much service as they get...

But, if you run the numbers for Wards 1-9 to get the average home price for people who pay 100% of the HSR tax assessment?

Wards 1-9 Average Sale Price: $233,792

That's 65.7% of the average in Dundas.

And again, for each $1 in HSR directed tax paid (in absolute terms) by a resident of Wards 1-9, the Dundas resident (with higher assessment) in absolute terms pays about $0.34

As I said in my post, Area Rating really changes how we should view some of these decisions.

By DBC (registered) | Posted January 26, 2015 at 11:22:10 in reply to Comment 108393

Well, I would stack up the assessed value of my home in Durand with any other part of the city.

When my children were in high school I had the pleasure of paying the highest transit taxes in the city and then got to purchase bus passes so that my kids could get to school.

Compare that to the suburbs:

lower taxes for transit + free school busing = fairness (I guess).

By Pxtl (registered) - website | Posted January 26, 2015 at 11:47:55

I will never understand how Flamborough/Ancaster got to be three wards instead of two. How is "one man, one vote" not good enough?

By area rating new CATCH article (anonymous) | Posted January 26, 2015 at 15:03:59

and see today on citizens at city hall CATCH hamilton catch org [can't put the real url here]

By a (anonymous) | Posted January 26, 2015 at 18:05:46

Wow - Hamilton is huge.

No it isn't. Hamilton, and it's kidnapped 'burbs is huge. They don't want to be there. LRT and AREA RATING and DECREPID downtown…..GET OUT NOW!

By GFY (anonymous) | Posted February 02, 2015 at 21:34:47 in reply to Comment 108436

For the record. Hamilton didn't 'kidnap' the 'burbs. The 'burbs helped elect the Mike Harris government and the Mike Harris government slammed us all together largely against our will. If we're looking to assign blame, the 'burbs should invest in a mirror.

You must be logged in to comment.

There are no upcoming events right now.

Why not post one?